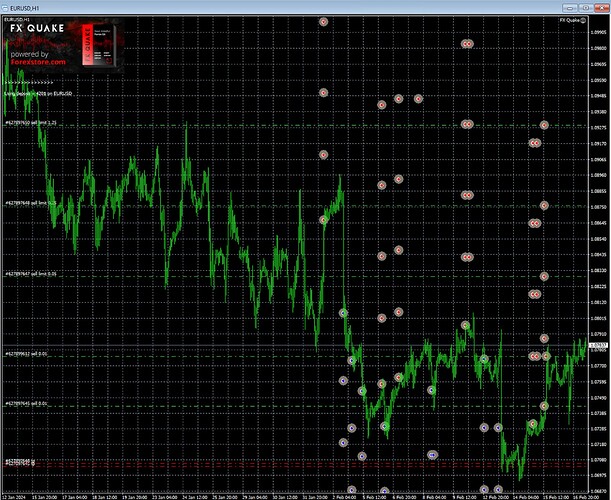

FX Quake EA Trading Robot Review

Overview:

FX Quake EA is a trading robot developed for the Forex market. It is designed to automate trading strategies, aiming to take advantage of market movements without requiring constant monitoring by the trader. This review will cover its key features, performance, ease of use, support, and value for money.

Key Features:

- Automated Trading: FX Quake EA operates 24/5, scanning the market for opportunities based on its pre-programmed algorithms.

- Strategy: It employs a unique trading strategy that combines trend analysis, price action, and various indicators to make trading decisions.

- Risk Management: The EA includes features for setting stop-loss, take-profit, and trailing stop levels to manage risk effectively.

- Customization: Users can customize certain parameters, including lot size, risk levels, and specific strategies to align with their trading goals.

Performance:

The performance of FX Quake EA can vary significantly based on market conditions, settings used, and the currency pairs traded. Potential users should review back-test results and any available real-account performance data to gauge its effectiveness. It’s important to note that past performance is not indicative of future results.

Ease of Use:

- Setup: The robot is relatively easy to set up on popular platforms like MetaTrader 4 or 5. Detailed installation guide is provided.

- Operation: Once set up, it runs automatically, making it suitable for traders of all experience levels.

Support:

Good customer support is crucial for any trading software. FX Quake EA’s developers have been quite good and helpful support is available via email.

Value for Money:

The value proposition of FX Quake EA depends on its purchase price, ongoing costs (if any), and its potential return on investment. Traders should consider these factors in light of their trading volume, capital, and strategy compatibility. The cost of FX Quake is currently $315. Ask then for a discount via email and they will give you a 5% discount. You can use it on one live account.

Pros:

- Automated trading reduces the need for constant market monitoring.

- Customizable settings allow for flexibility in trading strategies.

- Integrates with various currency pairs.

- Good solid profit so far.

Cons:

- Market risk and the possibility of significant losses exist, as with any trading activity.

- Performance can be highly variable and dependent on many external factors.

- Initial cost and any subscription fees may be a barrier for some traders.

In Conclusion:

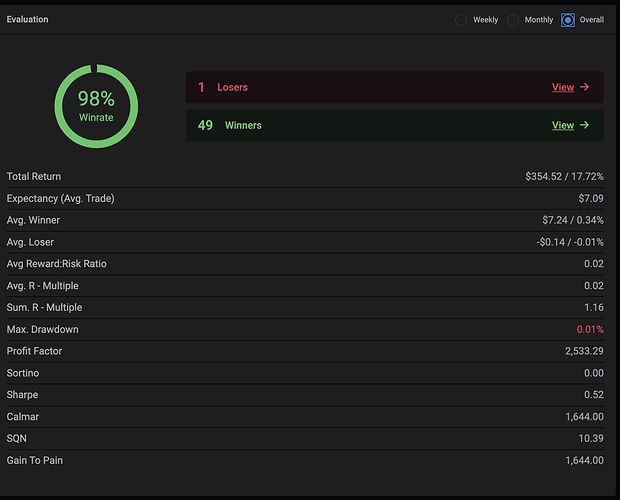

FX Quake EA presents an appealing option for traders looking to automate their Forex trading strategies. In the few weeks I have used this EA, it has brought some good profits. Overall 49 wins and 1 loss which is excellent. As with any trading tool, it’s essential to approach it with caution and realistic expectations about the risks and potential returns involved.

Check out the live trading results here: https://www.fxblue.com/users/fxtmquake

Keep your risk level under 2% and you should be OK. Also, make sure you use a decent broker. I use FXTM for FX Quake and it has been good so far. Still early days but I will update this review in the next few months to check the progress. But a return of 17% over a few weeks is not too bad.

Price

$315 (You can ask them and they may give you a 5% discount)

Rating

Where to buy